Exploring non-custodial services

· Jim McDonald · 11 minutes read · 2343 words ·What are non-custodial services?

Custody is the act of holding something on behalf of someone else. Custody is very common within day-to-day life: third parties are likely to hold on your behalf anything from money (outside of the cash in your wallet) to property (in the form of title deeds).

Custodial services are services that can only be provided by a third party with custody of the relevant assets. A typical example of a custodial service can be seen in the operations of a bank, where an individual deposits money in the bank at the time they open their account. Although the money is nominally still owned by the depositor there is no box sitting in a bank somewhere with their money in it; instead it is pooled with all of the money supplied by others and redirected for the banks’ purposes. This might include lending it to people or companies of which depositors might disapprove; purchasing competitors that reduces competition and individuals’ choice; and handing out high loan-to-value mortgages that inflate local house prices.

A graphical representation of the custody of assets in a custodial system, with the individual on the left, the company on the right, and the dividing line showing separation between the two, is shown below:

Figure 1: Custody of assets in a custodial system

In a custodial system, custody of assets moves from the individual to the company, and resides with the company for the duration that services are provided.

Of course, there is a legal requirement for the bank to return money if requested but there is no guarantee of the same. Instead, there are complex sets of rules laid down by governments in an attempt to limit the damage banks can do with your money and to compensate customers if things go wrong.

Custody is very much open to mismanagement and abuse. From lost paperwork to financial fraud, custodial services come with a host of risks. These are commonly mitigated by layers of legislation and compensation, but they are in turn expensive to build and maintain, and add a cost to services.

Non-custodial services are, by contrast, services that can be provided without custody of the relevant assets. Continuing our banking example, a non-custodial bank would provide similar services to the custodial bank but without the requirement of holding individuals’ money.

A graphical representation of the custody of assets in a non-custodial system is shown below:

Figure 2: Custody of assets in a non-custodial system

In a non-custodial system, custody of assets remains with the individual and at no time passes to the company.

Why would individuals want non-custodial services?

Individuals gain a number of benefits by using non-custodial services. Some of these are outlined below.

Ownership and control

Ownership of assets often confers benefits: holding shares, for example, can provide benefits from product discounts to voting rights. When the asset is held by a custodial service these benefits are often either unavailable or complex to obtain, resulting in the individual missing out on them. With direct control of the asset the full benefits can more easily be obtained.

This extends to use of assets: by holding their own assets individuals can be sure they are not used for purposes with which they do not agree, such as a bank using the assets to fund or invest in companies or industry sectors with which they have an ethical objection.

Risk reduction

Because the assets are held by the individual there are fewer opportunities for services to misuse them, through either incompetence or malice. The individual is always aware of the location of the assets, so there can be no games played with assets that may result in their loss (e.g. fractional reserve).

Management of assets

As the individuals’ assets are held by themselves it is easier to understand their overall financial situation. And because control of the assets is under a single account the controls to access the assets can be built by the individual to meet their needs rather than relying on the systems chosen by each service.

Flexibility of allocation

Assets that are retained by the individual allow for greater flexibility when it comes to their use for services. For example, rather than committing funds to a single loan company with fixed terms an individual can announce the terms they want in order to loan out their funds and as soon as any company meets the terms a loan offer can be made for some or all of the assets.

Why would companies provide non-custodial services?

At first glance it may seem that custodial services are better for the companies and non-custodial services better for the individuals. But non-custodial services also provide benefits to the companies that provide them, as outlined below.

Customer adoption

Companies are commonly required by governments to understand their customers and the source of the funds being deposited to avoid situations where companies unwittingly act as money launderers. If individuals hold their own funds much of this burden is removed, making it faster and easier for new customers to start using companies’ services.

Risk reduction

Companies that do not hold customer assets have far less to steal, and even if a theft is successful it has far less impact as customer assets are never held by the company. Being a lower-value target is in itself very much an advantage for a company, especially one that traditionally deals with assets.

Visibility of customers’ assets

Although not intuitive, non-custodial services can obtain better information about their customers’ assets than their custodial counterparts. Custodial services have no incentive to share data on their customers’ finances with other companies regardless of what the customers want. In contrast, with non-custodial services the individual controls who can see their financial information and is able to share it with companies with which they wish to interact, and it is even possible to provide this information anonymously to avoid privacy concerns.

Focus on core business

Holding assets and personal information is rarely a core business and far more commonly a cost; removing this burden allows companies to focus on providing value to their customers.

What do non-custodial services do?

Given that non-custodial services do not directly hold assets it can be hard to see their purpose: what would a bank without customer assets do? In general there are five different services that non-custodial companies can provide:

Information

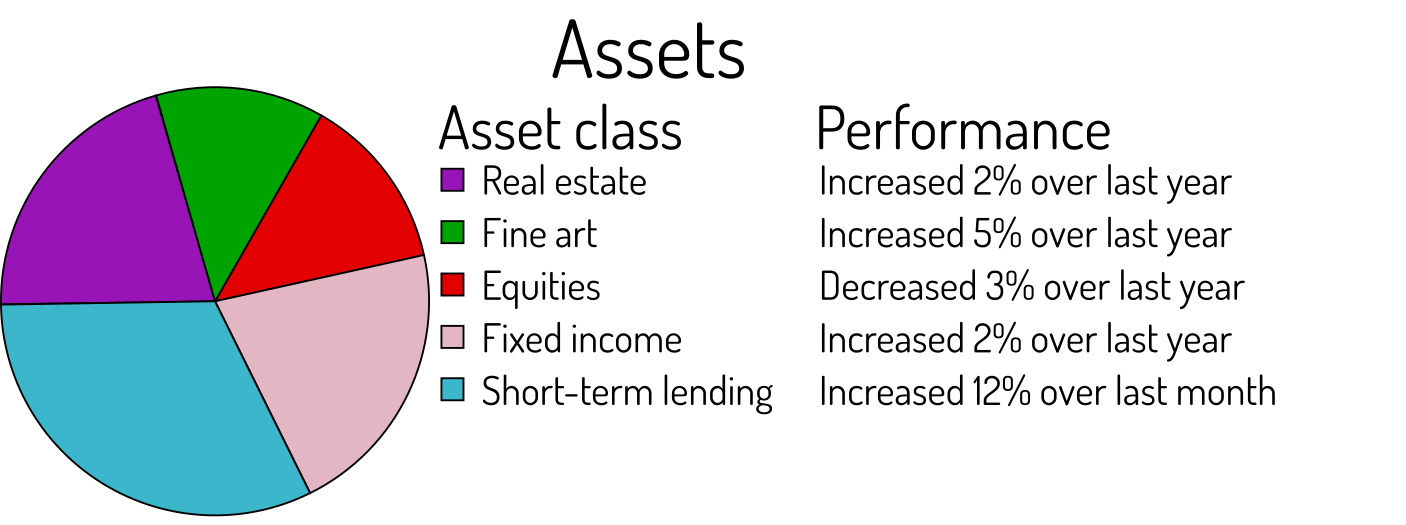

Non-custodial services can provide information about an individual’s situation. For example, a non-custodial bank might provide details about an individual’s assets: which classes they are in, their performance, their risk relative to the individual’s desired levels, etc.

Figure 3: Example information provided by a non-custodial bank

It can be seen that the bank has gathered individual assets into separate asset classes and provided information on performance for each asset class. Detailed information for each asset class would also be available, as would data grouped by region, risk level, etc.

Advice

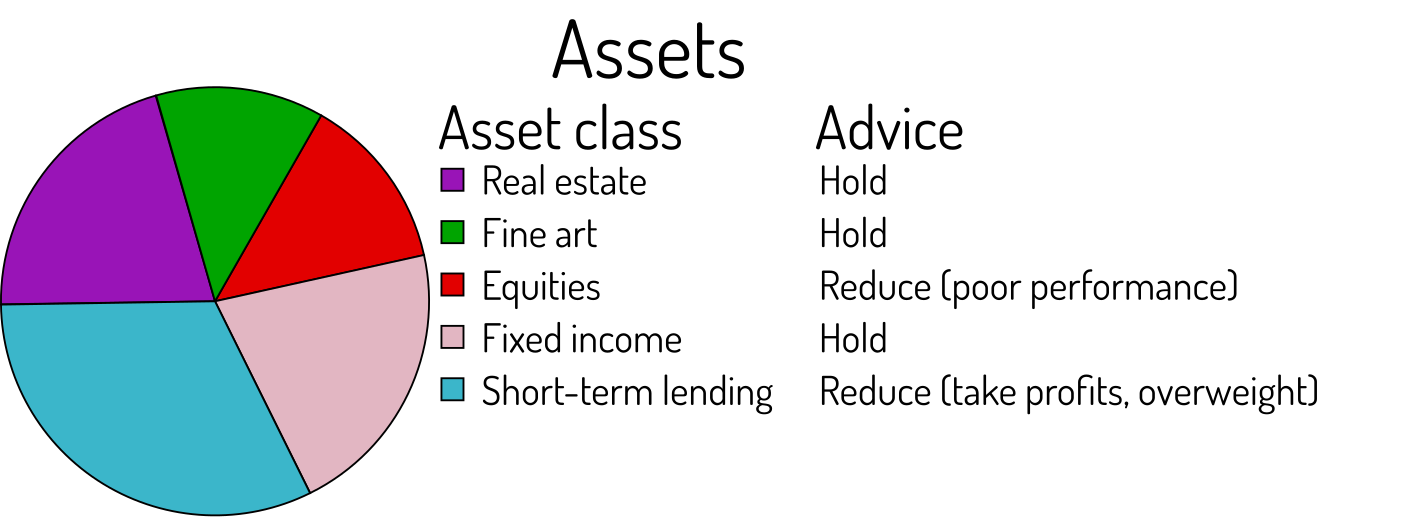

Advice provides suggestions to allow individuals to meet their goals. Continuing the example, the non-custodial bank might note that a customer’s assets have a much higher overall risk than the customer desires due to overexposure in a single market and as such they should reduce their holding.

Figure 4: Example advice provided by a non-custodial bank

It can be seen that the bank has provided advice on which asset classes to reduce, including the reasoning behind it.

Alerts

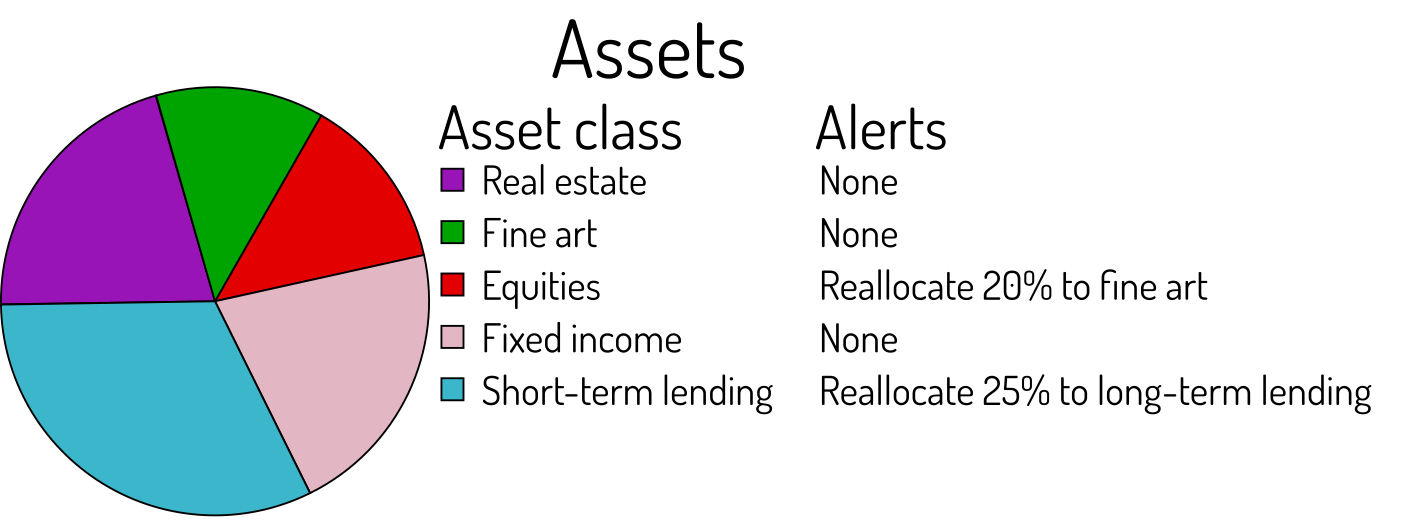

Alerts provide details of actions an individual should undertake to meet their goals. Continuing the example, the non-custodial bank might suggest a specific course of action to rebalance the assets as per the customer’s allocation requirements.

Figure 5: Example alerts provided by a non-custodial bank

It can be seen that the bank has provided specific information on how to rebalance both underperforming and overexposed asset classes.

Actions

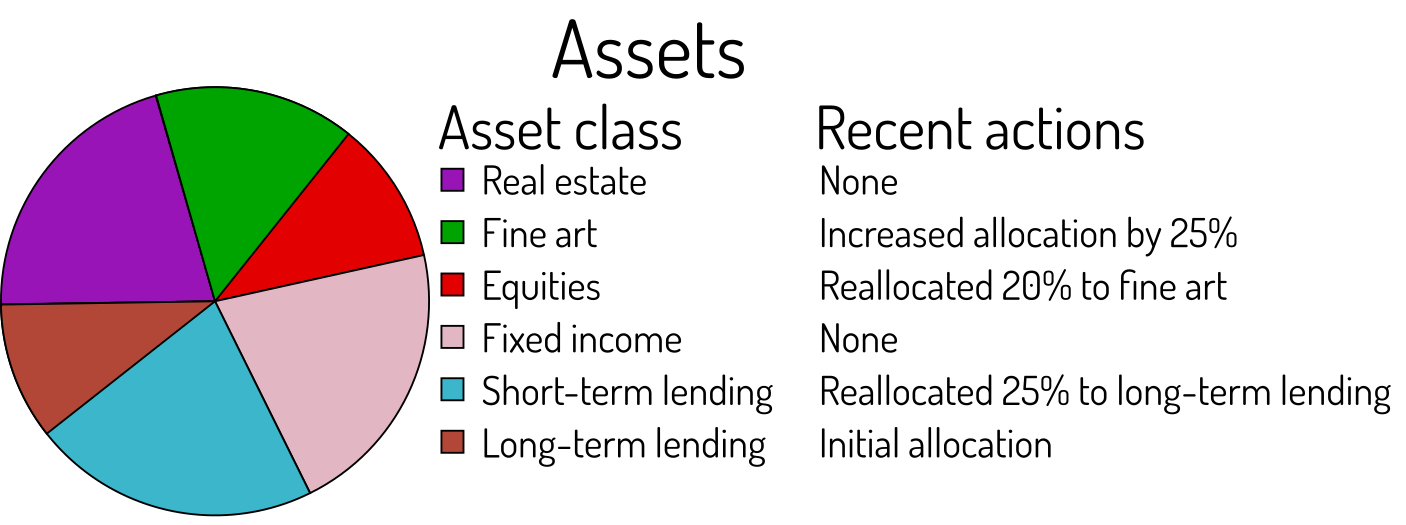

Actions are activities undertaken by the company on behalf of the individual. Continuing the example, the non-custodial bank might reallocate the customer’s assets according to the customer’s requirements.

Figure 6: Example actions provided by a non-custodial bank

It can be seen that the bank has taken action to sell both underperforming and overexposed asset classes, increasing holdings of a high-performance asset class as well as investing in a new asset class.

Interaction with the custodial world

Although non-custodial services have much to recommend them it is unlikely that all services will move to this model in the near future. As such, there will need to be bridges between the custodial and non-custodial worlds and these can be provided by non-custodial services.

For example, an individual might have a debit card issued by a non-custodial bank. At the time a purchase takes place the merchant, who still operates on a custodial model, would request payment from the bank. The bank would obtain the required funds from the individual, carry out any required currency exchange (e.g. crypto to fiat), and present them to the merchant, successfully bridging the custodial and non-custodial worlds.

Wallets and conditional transfer

The last two functions of non-custodial services given above involve reallocating and transferring an individual’s assets, but if the company does not have custody of the assets how can they do this? The answer is for the individual to allow transfer of some of the assets held when specific conditions are met.

For example, with the debit card example in the previous section the individual’s wallet might recognise the debit card transaction information. When the bank receives this information it presents it to the individual’s wallet, which automatically transfers the appropriate funds to the bank.

Wallets can hold conditional transfer requirements that are very specific. For example, an individual may want to lend out a portion of their assets to a borrower with the following requirements:

- term no more than 30 days

- interest rate at least 5%

- repayment guaranteed by insurance

- total amount of loan no more than $10,000

The individual sets up these requirements on their wallet and announces them to a set of brokers (who are themselves non-custodial services). When any of the brokers have a borrower request a loan that meets these requirements they provide details to the wallet and the smart contract automatically releases funds to the lender.

Similarly, with the prior example of a bank reallocating assets, the bank may be allowed to reallocate assets but only at a given rate, with results that meet the individual’s requirements, with limits on how much can be reallocated in a single transaction, etc. The requirements remain fully within the control of the individual at all times, ensuring the individual always has the ultimate say in what happens to their funds.

Disadvantages of non-custodial services

From an individual’s point of view the biggest downside with non-custodial services is they remain directly responsible for their own assets. This can be mitigated with various strategies, but there are few mainstream products to help with this and none that are suitable to cover the wide range of individual circumstances. There are, however, a number of companies working on this problem and the expectation is that over the next two or three years there will be enough mechanisms available for individuals to mitigate the main risk that non-custodial services brings to their assets.

From a company’s point of view non-custodial services do not have access to the liquidity of custodial services, obtained via customer deposits. This makes it more difficult for non-custodial companies to manage their cashflow. Non-custodial companies will need to move from an “arm’s length” separation of theirs and their customers’ funds to a complete lack of customer holdings.

To allow non-custodial services to obtain assets when required, individuals will need to hold their funds within smart wallets. Today there are no wallets that are suitable for this task, and some cryptocurrencies are poor platforms on which to build such wallets. As non-custodial services start to gain traction it is expected that smart wallets will go through a similar evolution to traditional crypto wallets: initial wallets will be written by companies focused on one or two products, but over time standards will evolve and smart wallets will be general-purpose gateways to many different products and companies.

The future for custodial and non-custodial services

Non-custodial services are in their infancy, and smart wallets likewise. How is this situation likely to progress?

The move from custodial to non-custodial services will be gradual to begin with. The first major non-custodial service of which most people are aware is the distributed exchange (DEX), with several companies already providing products. Additional non-custodial services are available for lending, insurance and more. The next logical step would be a non-custodial bank that acts as a single frontend to these and other services, providing information, advice and actions that use these services to meet individuals’ financial goals. Eventually, personal and corporate finance will consist of multiple layers of non-custodial services, with those at the top working with customers to define their financial goals and lower layers working to meet them.

The perceived risks of individuals maintaining control of their own assets will remain until smart wallets become the norm. As day-to-day use of smart wallets is made easier, and recovery of lost assets is made possible, individuals will start to receive and react to financial matters the same way they do with social matters today. Eventually, smart wallets will be given large amounts of autonomy to act on behalf of their owner, and will able to handle all but the most complicated of decisions once individuals have set their financial goals.

Ultimately, successful non-custodial services will be able to provide better services at lower cost than their custodial counterparts. Take in to account the additional control and freedom that non-custodial services will bestow on individuals and it is clear that they will only increase in popularity over time.